Product-Market Fit: How to Find It and Measure It

Contents

You have a fantastic idea for a new product. You can’t wait for it to hit the market. Unfortunately, the odds of it being successful aren’t exactly in your favor.

According to Harvard Business School professor Clayton Christensen, about 30,000 new consumer products hit the market every year, of which 95% are destined to fail.

The extreme minority — products that succeed — are those that achieve product-market fit.

What Is Product-Market Fit?

Whether they’re launching a single new product or a whole new business, everyone wants to know whether or not there’s a market for their game-changing idea.

And while the statistics in the previous section suggest the overwhelming majority of ideas aren’t successful, there are lots of signs that can help you identify product-market fit.

In short, product-market fit means being in a good market, with a product capable of satisfying that market. It could achieve this by fixing a problem that previously didn’t have a solution, or by working better or carrying a cheaper price point than the alternatives.

All too often, entrepreneurs and brands focus on trying to satisfy their market, without first clarifying that the market is “good”. Assuming the product is halfway decent and the team behind it is competent, choosing a great market will more often than not produce successful outcomes, whereas a poor market will generally end in failure even if the product and team are strong.

5 steps to finding product-market fit

Product-market fit can also be thought of as product-people fit. After all, a market is ultimately a group of people. It’s your job to target those people effectively with a product they actually want to buy.

In order to do that, you need to establish a deep understanding of the people you’re trying to reach, then use that information to figure out how your product fits in. Here are five steps to help you do it.

1. Identify your target customer

It all starts with your target audience — the people who will ultimately decide whether or not your product is worth buying, and therefore have the capacity to make it a success (or failure).

Research the scale of the market to understand how many people you will theoretically be able to reach and how much money you could make if your product captures the imagination. Then divide the people within that market into segments that share similar properties and traits, such as:

- Age

- Location

- Household wealth

- Hobbies and interests

- Priorities

Defining these segments will allow you to construct buyer personas — that is, one or more fictional characters that describe the person or people most likely to buy your product. Present these personas to your product team so everyone is clear on exactly who you’re aiming to serve.

2. Talk to your buyer

Having drawn up your buyer personas, it’s time to get to know the real people on which they’re based. At this stage, you likely have various theories about what they want from a product like yours; this is your opportunity to prove or disprove those theories, and identify new behaviors, motivations, and needs that would otherwise have been overlooked.

Social media, website forums, and online surveys can help you reach a broad range of potential customers quickly and effectively. However, in an ideal world, you should also strive to speak to your buyers in person — either on the phone or, ideally, face to face.

Remember: the goal here isn’t to pitch prospective customers on the various benefits of your product. After all, at this stage, it doesn’t even exist. Talking up all the positives might persuade a few people that your product is worth buying, but it won’t help you iron out any of the creases or understand all the potential ways in which you can add value.

3. Know what you offer as a value proposition

Speaking of “value” brings us nicely to the next step — defining your value proposition.

The value proposition is a simple, concise statement that sums up why a customer would buy your product. This helps you figure out possible tactics to help you beat the competition. After all, there are likely several other companies offering similar products already. What sets yours apart?

Your value proposition cannot be a list of generic features and benefits. It should be something unique that truly helps you stand out and makes it obvious why your product is the right solution. Clearly, defining your value proposition becomes far simpler when you already understand who your buyers are and exactly what they’re looking for in a product.

4. Specify your minimum viable product feature set

Creating a minimum viable product (MVP) is a crucial step to establishing product-market fit.

Simply put, an MVP is a version of your product that is ready to launch, but has only the most essential features necessary for it to offer value to buyers. Often, an MVP has a pretty rudimentary design, with none of the “nice-to-haves” that make it enjoyable to use. But it does the basics effectively.

There are lots of benefits to building an MVP. For starters, it can:

- Help you secure pre-launch funding

- Allow you to capture valuable customer feedback, thereby removing some of the risk from your full launch

- Enable you to hit the market faster, before someone else fills the gap or interest starts to wane

- Give you vital data and other information to hone your marketing messaging

- Validate your pre-launch research

Of course, to achieve those benefits, you first need to define the stripped-back feature set of your MVP. These features should closely align with your value proposition. Anything over and above your basic value proposition can wait until a later update or full launch.

5. Measure your product-market fit

Finally, it’s time to assess whether you’ve successfully established product-market fit by tracking your performance against key data points.

One of the most useful metrics here is your total addressable market. This is the absolute maximum number of people who could potentially buy your product. Once you have a figure, you can simply calculate what percentage of the total market is already using your product, which shows you the scale of opportunities awaiting you.

4 Metrics for Measuring Product-Market Fit

We’ve touched on one viable method for measuring product-market fit.

However, gaining an accurate understanding of product-market fit is so important that you can’t rely on just a single metric; considering a wealth of data points can give you confidence that you’re on the right path. Or, if you aren’t, you have the opportunity to course correct before it’s too late.

With that in mind, here are four more methods to help you measure product-market fit:

1. Sean Ellis survey method

Most applicable to early-stage startups, as opposed to established businesses looking to expand their product line, the Sean Ellis survey method revolves around asking a single question: “How disappointed would you feel if you could no longer use this product?”

According to Ellis, the author of Hacking Growth and a growth strategist who founded Qualaroo, this approach works because it helps companies identify their core customers. In turn, this enables them to build accurate buyer personas and highly targeted marketing campaigns around those customers.

Back in 2015, Hiten Shah — founder of Crazy Egg, KISSmetrics, and Quick Sprout — used this method to evaluate whether business communication platform Slack had product-market fit. Sending a Typeform survey, he received answers from 731 respondents, 51% of whom said they would be “very disappointed” if they could no longer use Slack.

Today, Slack has more than 10 million daily active users, and it’s pretty clear the platform does indeed have product-market fit.

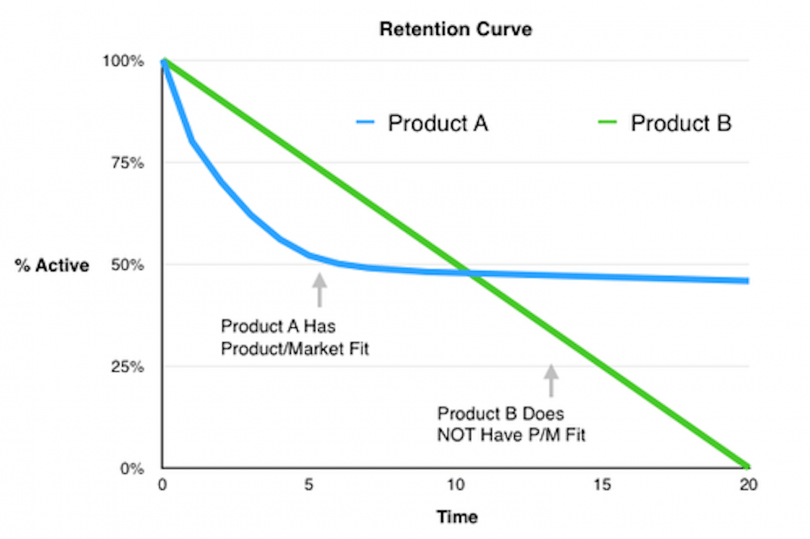

2. Cohort retention

Cohort retention involves measuring the proportion of customers who keep paying for a product once a certain time period — typically eight weeks — has passed.

As such, it’s an effective method for relatively established products for which historic customer data is available, but it’s less relevant for startups or brand new products. However, if you do have the necessary data, it can be an extremely valuable metric.

Cohort retention rate is often displayed as a simple line graph, with time displayed on the X axis and the proportion of active, paying customers on the Y axis. If the line levels off somewhere above the X axis, this is a good indication that you’ve found product-market fit, whereas if it continues to decline, you’ve likely missed the mark on your audience or the size of the market.

3. Net Promoter Score (NPS)

NPS is a classic metric used to assess levels of customer satisfaction, but it can also be used to establish product-market fit.

Again, NPS involves a simple survey question, this time asking the customer: “How likely is it that you would recommend this product to a friend or colleague?”

Respondents are instructed to answer the question by leaving a score from 1-10. Those who give a score of six or lower are classified as “detractors”; scores of seven or eight are referred to as “passives”; and respondents who award a score of nine or 10 are termed “promoters”. NPS is then calculated by subtracting the percentage of detractors from the percentage of promoters.

While NPS can be a useful guide to whether you have product-market fit, it doesn’t tell the full story. For instance, respondents could be end users rather than the decision-makers who decide whether or not to keep using the product.

4. Lifetime value to customer acquisition ratio (LTV/CAC)

The customer lifetime value metric can be one of the most powerful indicators of product market fit. It is calculated as follows:

- Calculate your LTV: Gross margin percentage X Average monthly payment / Churn rate

- Calculate your CAC: Sales and marketing costs / New customers won

- Divide LTV by CAC

In short, it defines how much money it costs you to win a new customer, versus the amount you make back from them when they use your product. Clearly, if it costs you a whole lot more to sign someone up than you’re ever going to make back from them, that’s a pretty clear sign you don’t have product-market fit.

Product-Market Fit Questions

It should be apparent by now that product-market fit and surveys go hand in hand. Surveys help you understand who your potential customers are and what they want from your product; and they give you the data to confirm whether or not you’ve actually established product-market fit.

Here are eight examples of survey questions to ask throughout your journey, along with multiple choice responses and other supporting information where relevant.

1. How would you feel if you could no longer use this product?

A. Very disappointed

B. Somewhat disappointed

C. Not disappointed (it really isn’t that useful)

D. N/A I no longer use it

This is the Sean Ellis survey question. According to Ellis, if 40% or more of your customers say they’d be “very disappointed” if they could no longer use your product, that’s a strong indication you’ve got product-market fit.

2. What would you use as an alternative if this product was not available?

A. I probably wouldn’t use an alternative

B. I would use (empty text box for answer input)

3. What is the main benefit that you get from using this product?

4. What type of person do you think would benefit most from this product?

5. How can we improve this product to best meet your needs?

6. What motivated you to use our product?

7. Why are you using our product as opposed to other solutions?

8. What makes our product a must-have product?

Conclusion

It’s impossible to overstate the importance of product-market fit. If you don’t have it, you need to go back to the drawing board, because you’re never going to make enough money to outweigh your acquisition and operational costs.

Fortunately, understanding whether you’ve got it or not is simply about asking the right questions, to the right people, at the right times. So there’s really no reason not to do it.