11 Sales Compensation Plan Examples To Inspire Reps

Contents

Sales compensation plans are a critical part of any sales organization. A good sales commission rate can play a key role in attracting, motivating, and retaining talented sales representatives.

There are many different types of sales compensation plans, and each has its own set of benefits and drawbacks.

In this post, we’ll share several sales compensation plan examples and break down how they work. We’ll also highlight the importance of creating a compensation plan that meets your organization’s specific needs.

What Is a Sales Compensation Plan?

A sales compensation plan outlines the salary, commissions, bonuses, and other forms of compensation that will be paid to sales representatives. The plan should be designed to align with the organization’s overall business strategy and sales goals.

Compensation is at the core of any good sales organization, as it is a key factor in attracting and retaining top sales talent.

Why You Need a Sales Compensation Plan

Sales is a high-stress and high-turnover position. And turnover can be expensive.

According to the Bureau of Labor Statistics, the median tenure for sales representatives is just over three years.

Considering that the average company spends between $10,000 and $15,000 to hire a new sales representative, you can see how high turnover can quickly become expensive.

A good sales compensation plan can help alleviate some of this turnover by providing incentives for sales reps to stay with the company.

The right mix of salary, commissions, and bonuses can also motivate sales reps to achieve high levels of performance.

In fact, more than half of employees are looking to leave or would consider leaving their job if the compensation wasn’t right.

How Sales Compensation Plans Work

To be effective, sales compensation plans need to be designed carefully to align with the company’s overall business strategy and sales operations objectives.

For example, if the goal is to increase market share, then the plan should incentivize sales reps to sell to new customers.

If the goal is to increase customer loyalty, then the plan should incentivize sales reps to upsell and cross-sell existing customers.

And if you’re looking to inspire team leaders, you’ll want a sales manager compensation plan that provides some security while incentivizing managers to build a team that sells.

Some important terms to know include:

- Sales quota: this is the minimum amount of sales that a rep must achieve in order to receive a commission.

- Sales accelerator: this is an added bonus that a sales rep can earn if they exceed their sales quota.

- Sales decelerator: this is a penalty that a sales rep will incur if they do not meet their sales quota.

- Spiff: this is a one-time bonus that is paid to a sales rep for achieving certain objectives, such as making a certain number of sales in a specific product category.

- Clawbacks: this is a provision in a sales compensation plan that allows the company to recoup commissions that have been paid to a sales rep if it is later discovered that the sales rep engaged in fraudulent activity or if the sale is canceled.

- OTE: on-target earnings, or OTE, is a measure of what a sales rep can expect to earn in a year if they meet their sales targets.

Examples of Sales Compensation Plans

Below are a few examples of different types of sales compensation plans that you can use to inspire your team.

Salary Only

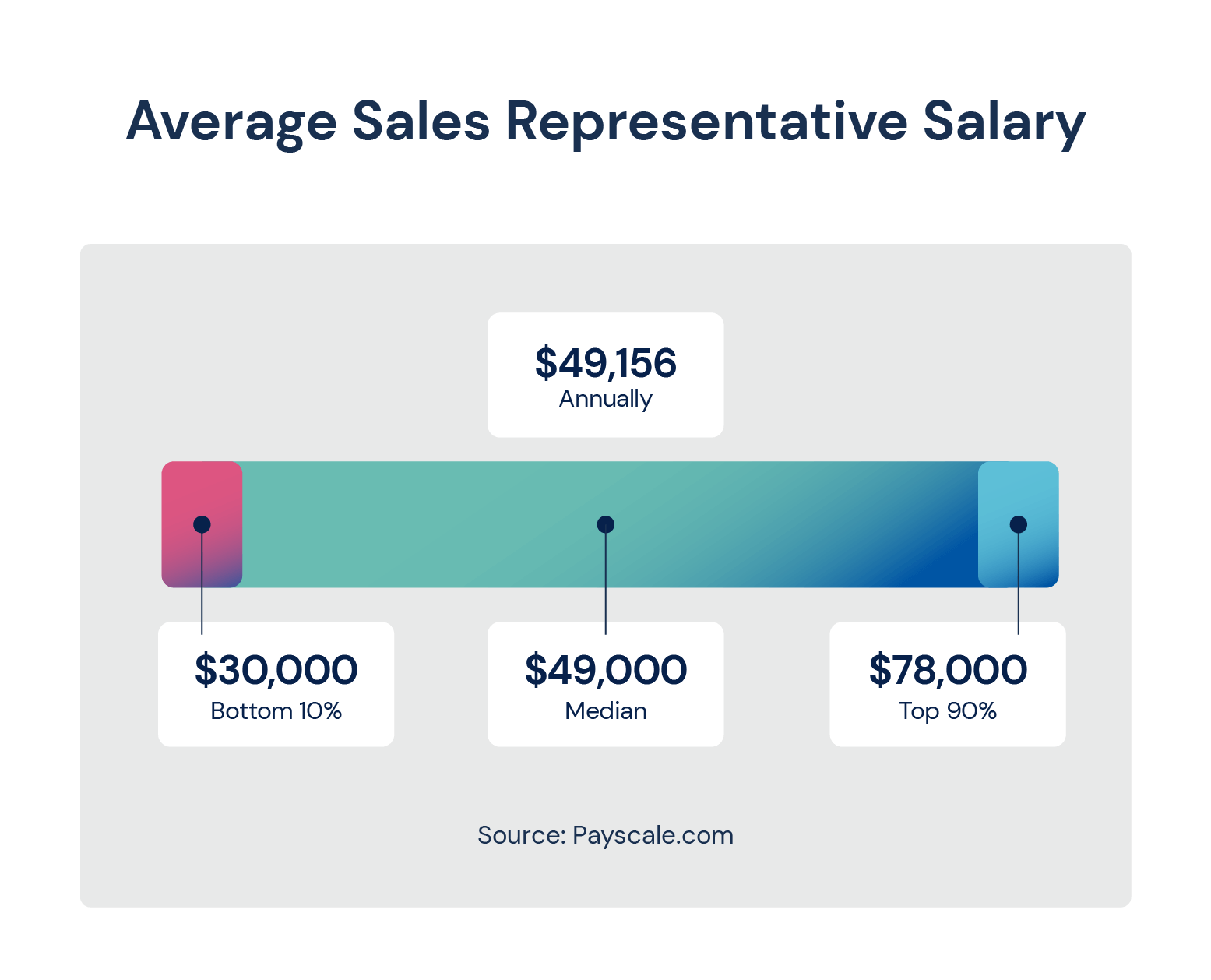

This is the most clear-cut compensation plan, as it simply provides a fixed income that is paid out regardless of whether sales are made. Considering an average salesperson earns just under $50,000, it may be a lower overall rate than some other types of compensation. It’s still appealing, however, because it can provide sales reps with a sense of stability and predictability in their earnings.

Pros of a salary-only plan include:

- Predictable payroll expenses

- Easier to comply with regulations

- Promotes equality

Cons of paying a salary-only plan include:

- Top-performing sales representatives are not incentivized for their work and could want to earn more

- Representatives may not see much upside for strong performance

- May reduce competition

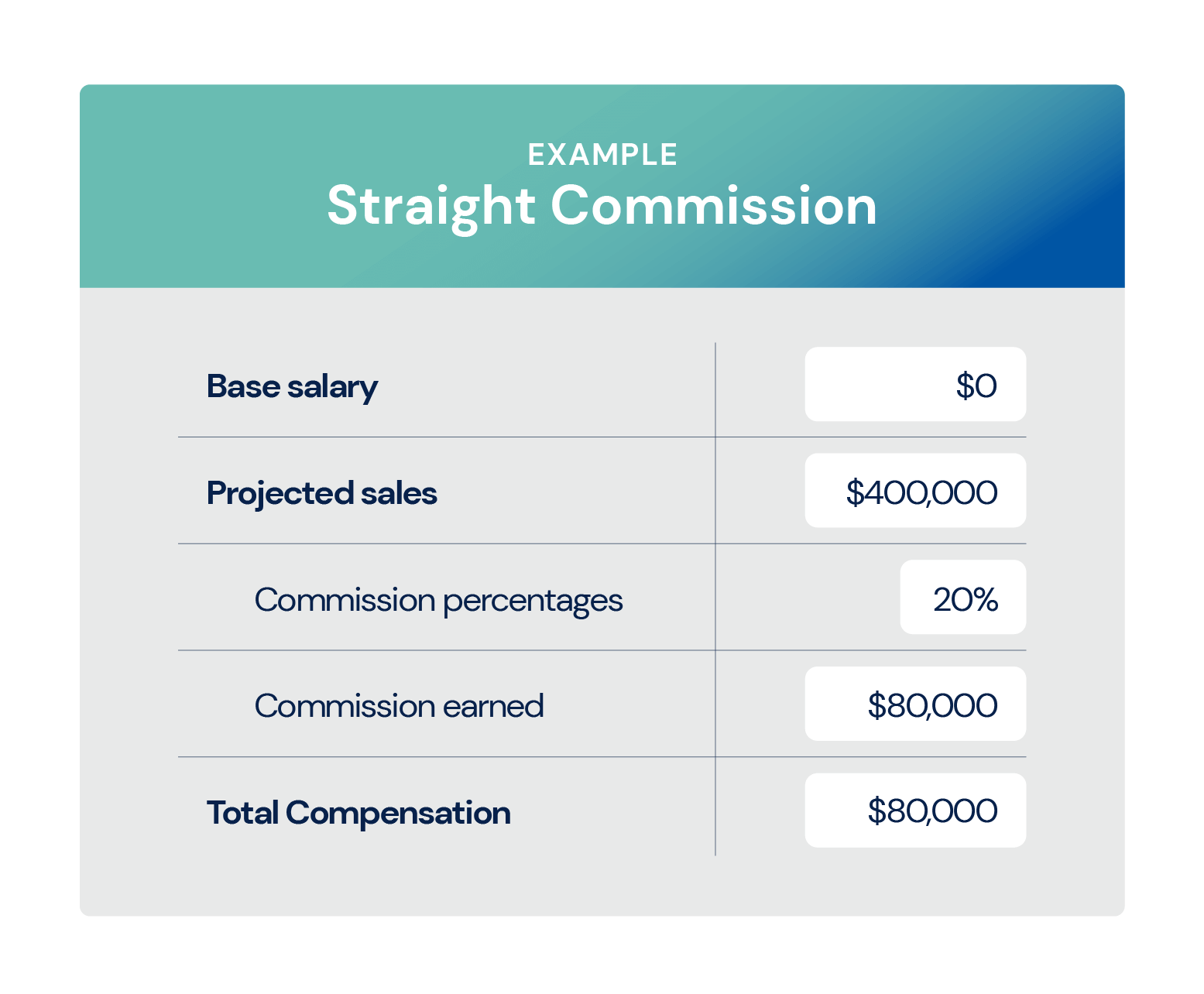

Straight Commission

As the name suggests, straight commission sales compensation plans are a type of compensation agreement where representatives are paid based only on what they sell.

Commission plans can also use sales accelerators when salespeople exceed their quotas, or sales decelerators as a penalty when salespeople are falling significantly short of their quotas.

There are two primary types of commission-only compensation plans:

- Compensation based on net revenue

- Compensation based on gross margin, sometimes referred to as gross profit margin

Net revenue commission plans are the most common type of commission-only compensation plans. This is where a commission is paid out as a percentage of the total sales made by the representative, minus any refunds or returns.

Gross margin commission plans are less common, but they can be more advantageous for certain types of businesses. With this type of plan, reps are paid based on the gross profit margin of their sales. The gross profit margin is calculated by taking away the cost of goods and services sold from the selling price.

It’s essential to consult with your revenue operations team to determine which is the best route for your business.

Pros of straight commission include:

- Easy to administer

- Provides great value for your money

- Performance is transparent

Cons of straight commission include:

- Commission-only sales jobs have high burnout rates

- Too much competition can lead to toxic work environments

- Payroll expenses can be unpredictable

Salary Plus Commission

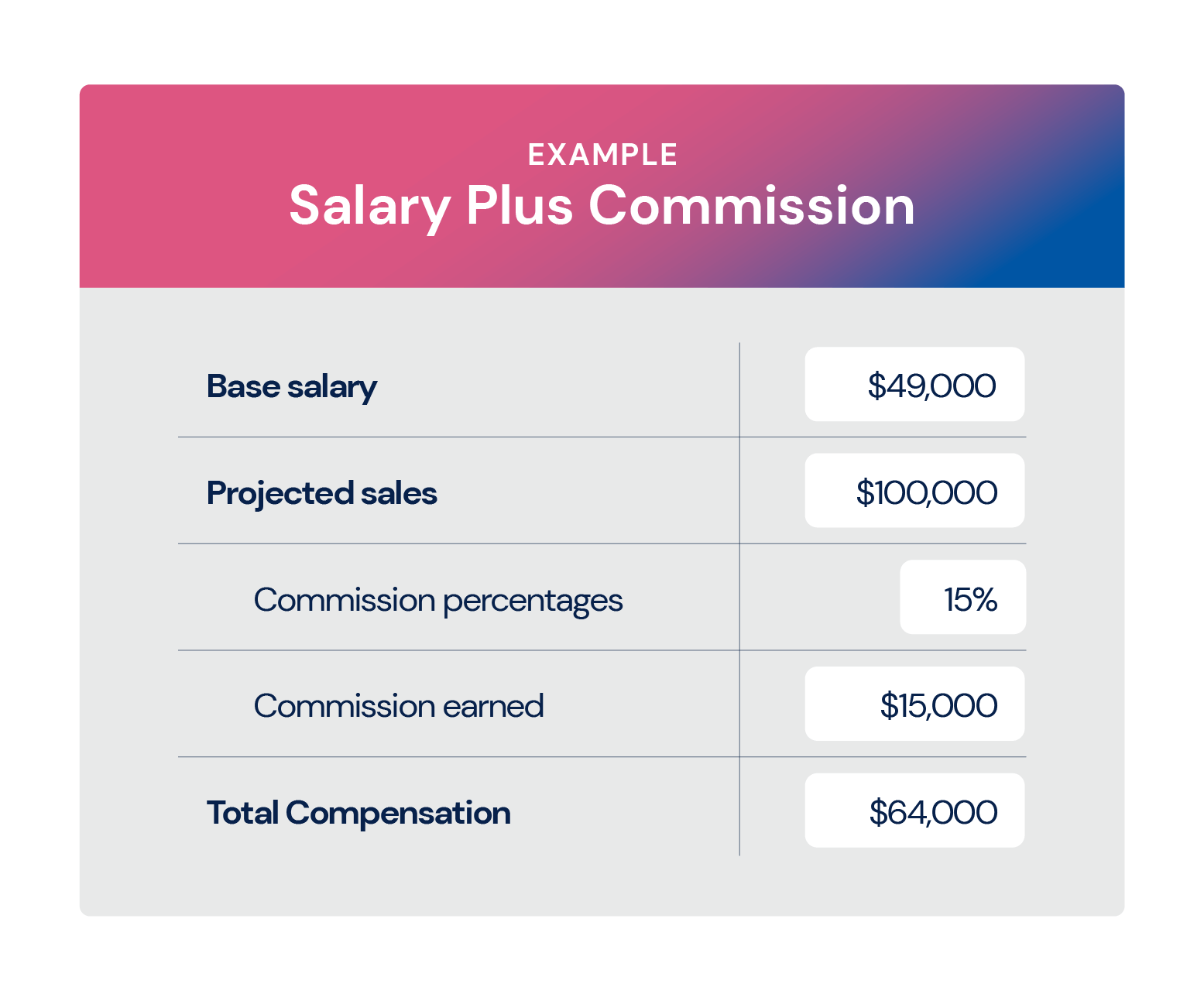

This type of compensation is like a salary, but with a twist. In addition to a fixed regular payment, representatives also earn a commission on sales they generate, usually after meeting a sales quota.

The commission rate is often a percentage of the sales price and may increase as sales volume goes up.

Pros of salary plus commission include:

- Motivates reps to sell more

- Helps attract and retain top talent

- Commission payments can be tailored to meet specific business goals

- May help reduce overall payroll expenses

Cons of salary plus commission include:

- Paying commissions can be complex and time-consuming

- May discourage reps from selling lower-priced items

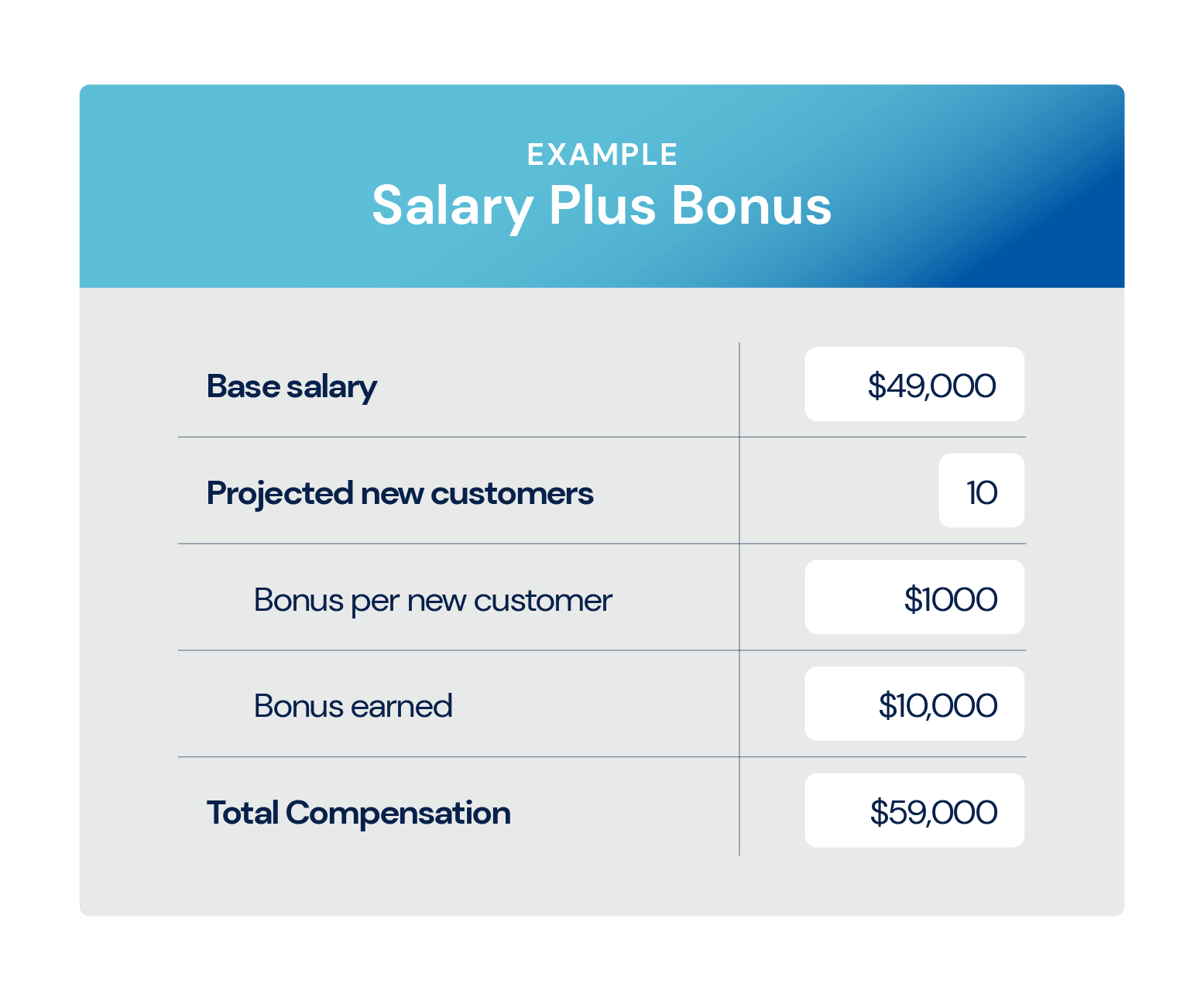

Salary Plus Bonuses

Many companies choose to supplement a base salary with bonuses. Sales accelerator bonuses can be awarded for meeting or exceeding sales goals, for example, or for other accomplishments, such as bringing in new customers.

Pros of salary plus bonuses include:

- Motivates sales reps while providing the security of a salary

- Increases loyalty of sales reps

Cons of salary plus bonuses include:

- Employees may be disappointed if there is no bonus or if bonuses are too low

- Managing expectations can be challenging

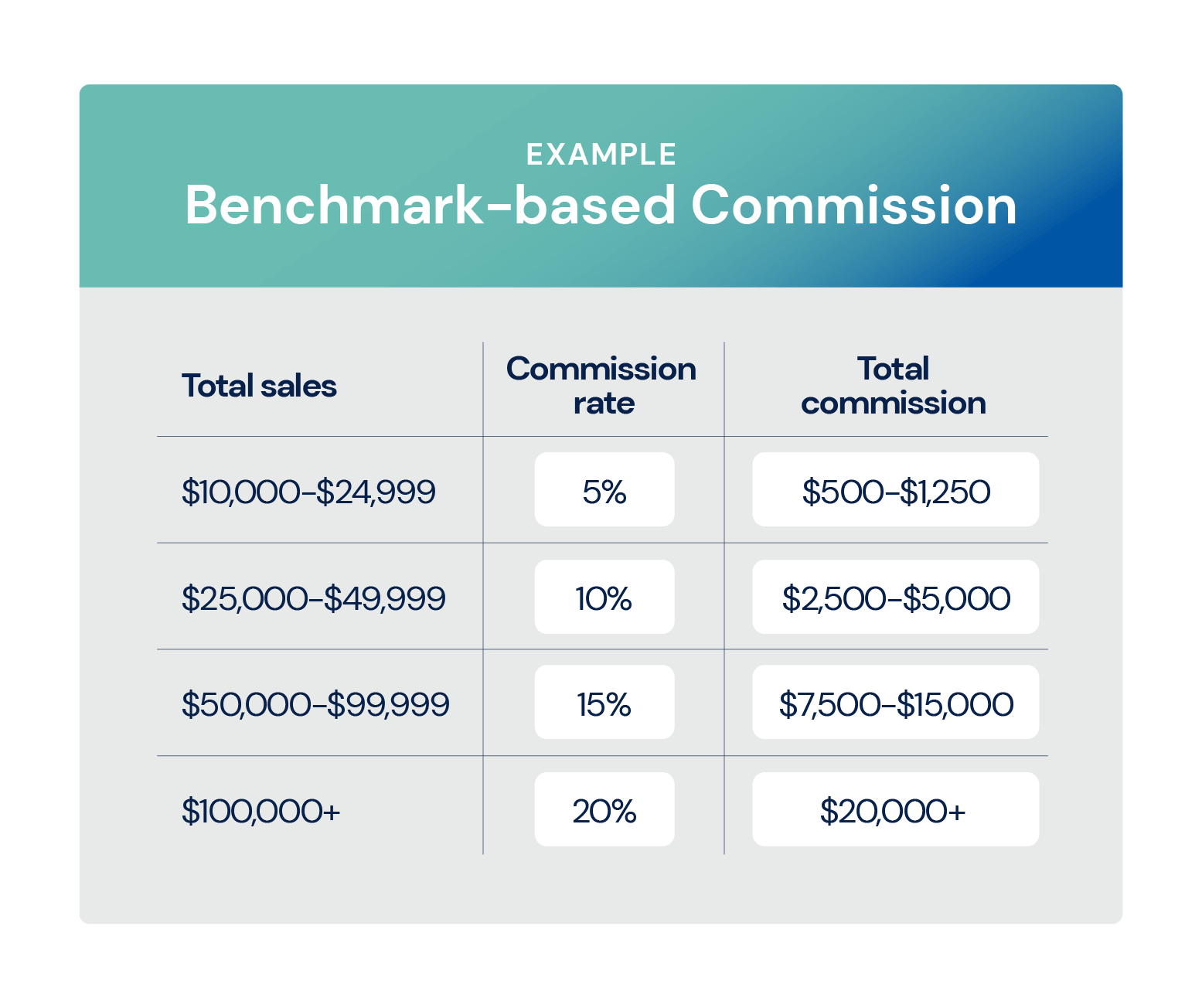

Benchmark-based Commission

Benchmark-based commission, or a tiered commission structure, is a type of sales compensation paid in lieu of a regular salary, in which reps earn a commission based on reaching certain benchmarks.

Common benchmarks include gross margin, number of units sold, or total revenue generated.

Pros of benchmark-based commission include:

- Motivates sales reps and promotes competition

- Inspires upselling and cross-selling to bump average ticket sizes

- Encourages representatives to go above and beyond simply meeting a quota

Cons of benchmark-based commission include:

- It can be confusing for sales reps

- Tiered commission can be costly if not planned appropriately

Draw Against Commission

Draw against commission is an incentive that is usually given for commission-only compensation plans, allowing reps to take an advance or “draw” against future commissions. This draw is typically a percentage of sales targets, and it’s paid out periodically (usually monthly).

The advantage of this type of plan is that it gives reps a guaranteed income through a salary, which can help with cash flow. However, if sales targets aren’t met, the rep may have to repay the advance.

Pros of a draw against commission plan include:

- Provides salespeople with a regular source of income

- Motivates sales reps to continue meeting sales targets

Cons of a draw against commission plan include:

- Salespeople could dig themselves into a hole if they are underperforming

- You could lose the draw if an employee quits

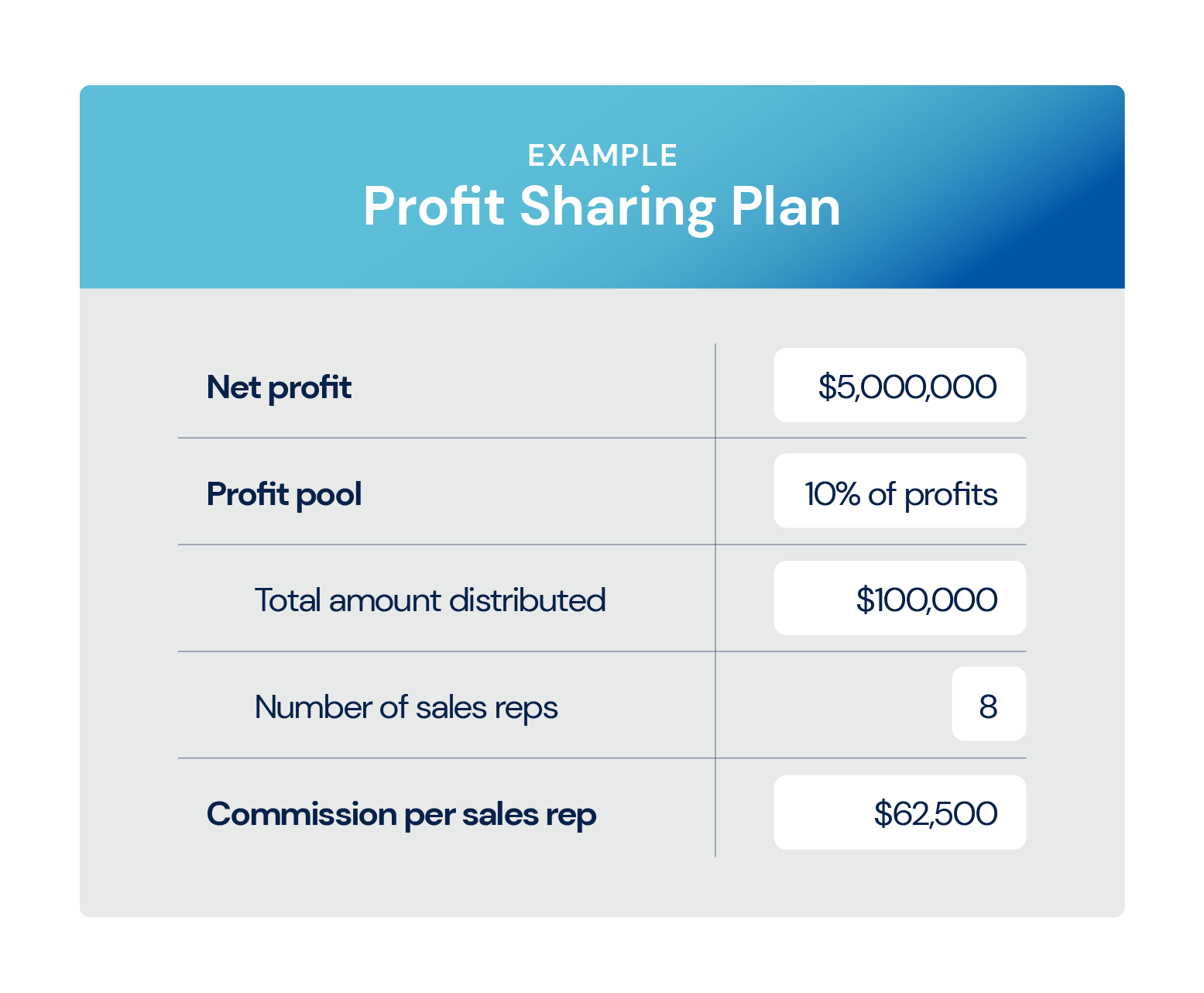

Profit Sharing

Profit-sharing plans are another type of sales compensation plan that can be used in addition to a base salary to incentivize reps. With this type of plan, a certain percentage of a company’s profits are pooled and distributed among employees.

Pros of a profit-sharing plan include:

- Businesses can defer taxes on profits that are distributed to employees

- Employees feel more ownership over the company’s success, leading to increased loyalty and lower turnover

- Profit sharing is a desirable perk which can lead to lower recruitment costs

- Profit-sharing bonuses are easy to calculate compared to other commission plans

Cons of a profit-sharing plan include:

- Businesses will have less money for research and development, marketing, and other business objectives

- Profit sharing can create dissent if high-performing reps are being compensated the same as low-performing peers

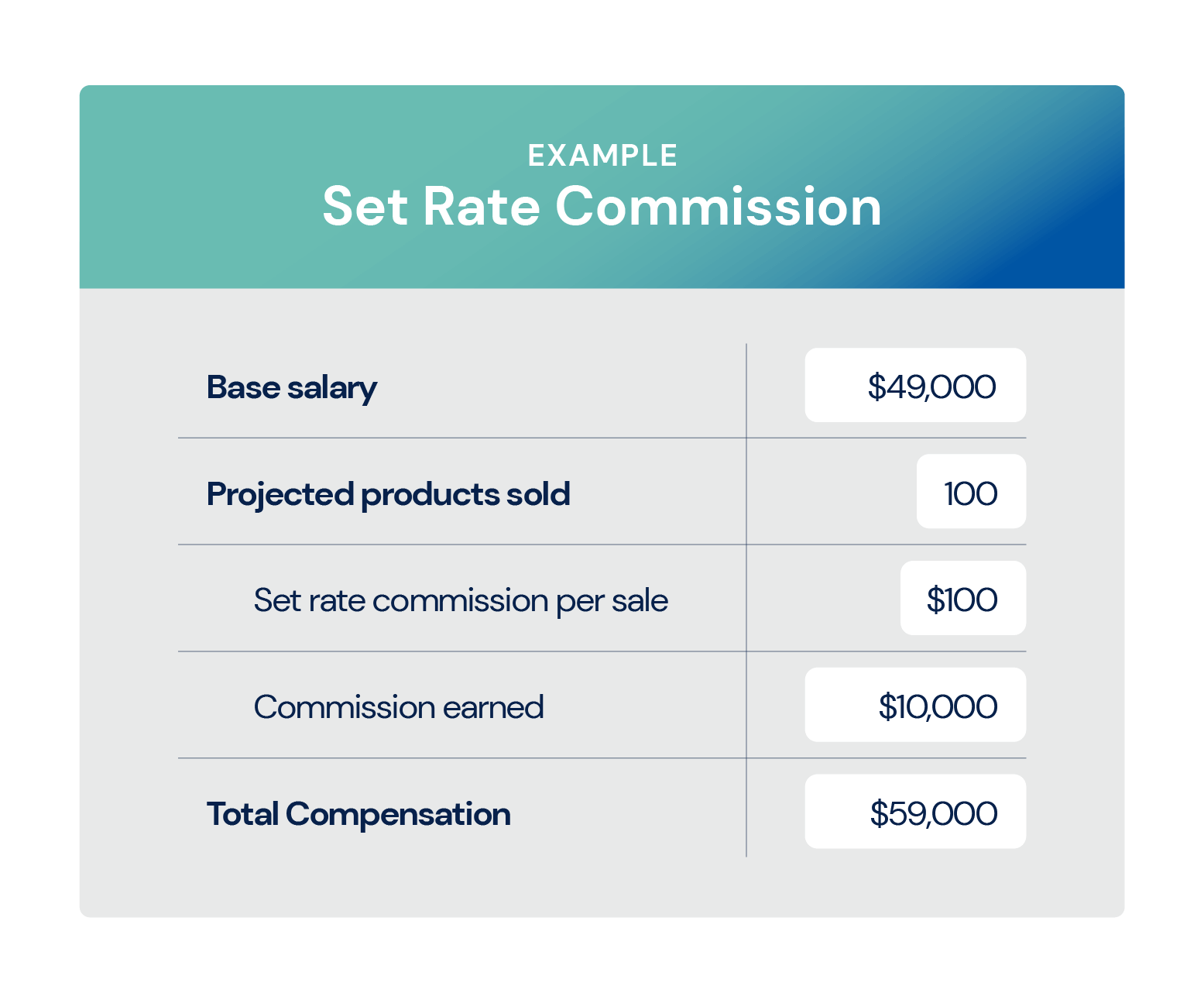

Set Rate Commission

Set rate commission plans are a type of compensation plan that pays employees a set dollar amount for each sale. The dollar amount may differ from product to product, but it provides businesses with an easy-to-predict sales expense.

Pros of a set rate commission plan include:

- Great value for money spent

- Easy-to-calculate margins

Cons of a set rate commission plan include:

- It may not attract top-tier salespeople

- It could lead to high turnover if reps do not feel like they are earning enough

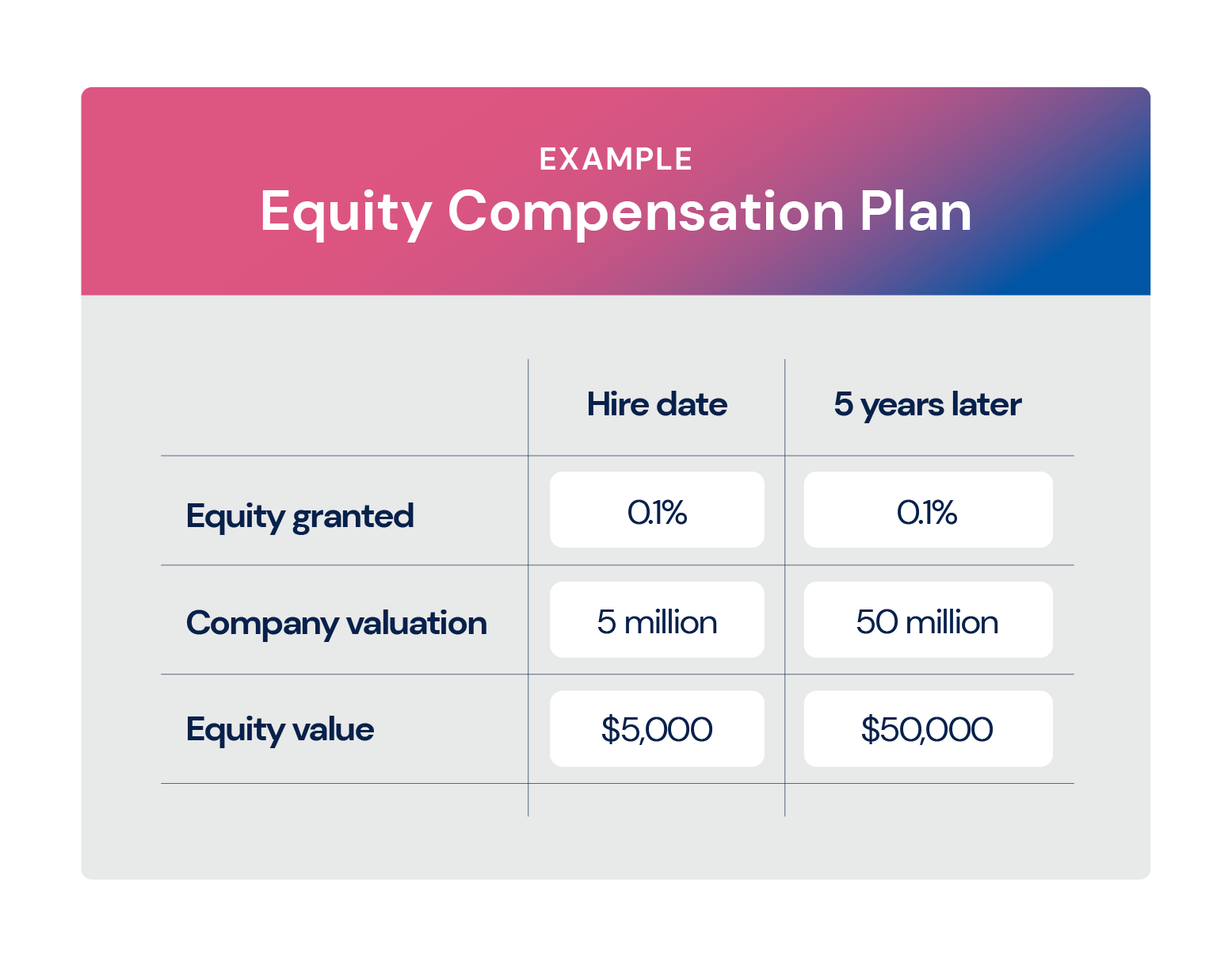

Equity

Equity is a common incentive for startups looking to attract top talent without straining their operating capital. And while it was once most common for engineers, advisers, and other long-term employees, it is now gaining traction as a popular incentive for salespeople as well.

With an equity-based compensation plan, employees are given a stake in the company in addition to a base salary. Equity is usually granted upon hire or when an employee reaches certain benchmarks. Most equity plans for sales professionals fall in the 0.025% and 0.9% range.

Equity is very desirable, as it gives employees a sense of ownership in the company and aligns their interests with those of the shareholders.

There are several types of equity-based compensation plans, including:

- Incentive stock options

- Nonqualified stock options

- Deferred compensation

Pros of an equity compensation plan include:

- Very appealing to top-tier talent

- Flexibility in when it’s paid out

- Great for startups without much operating capital

- Employees will likely stay longer and be more involved in the company

Cons of an equity compensation plan include:

- You are giving away a share of ownership in your company

- Navigating taxes and regulations can be difficult for companies and employees alike

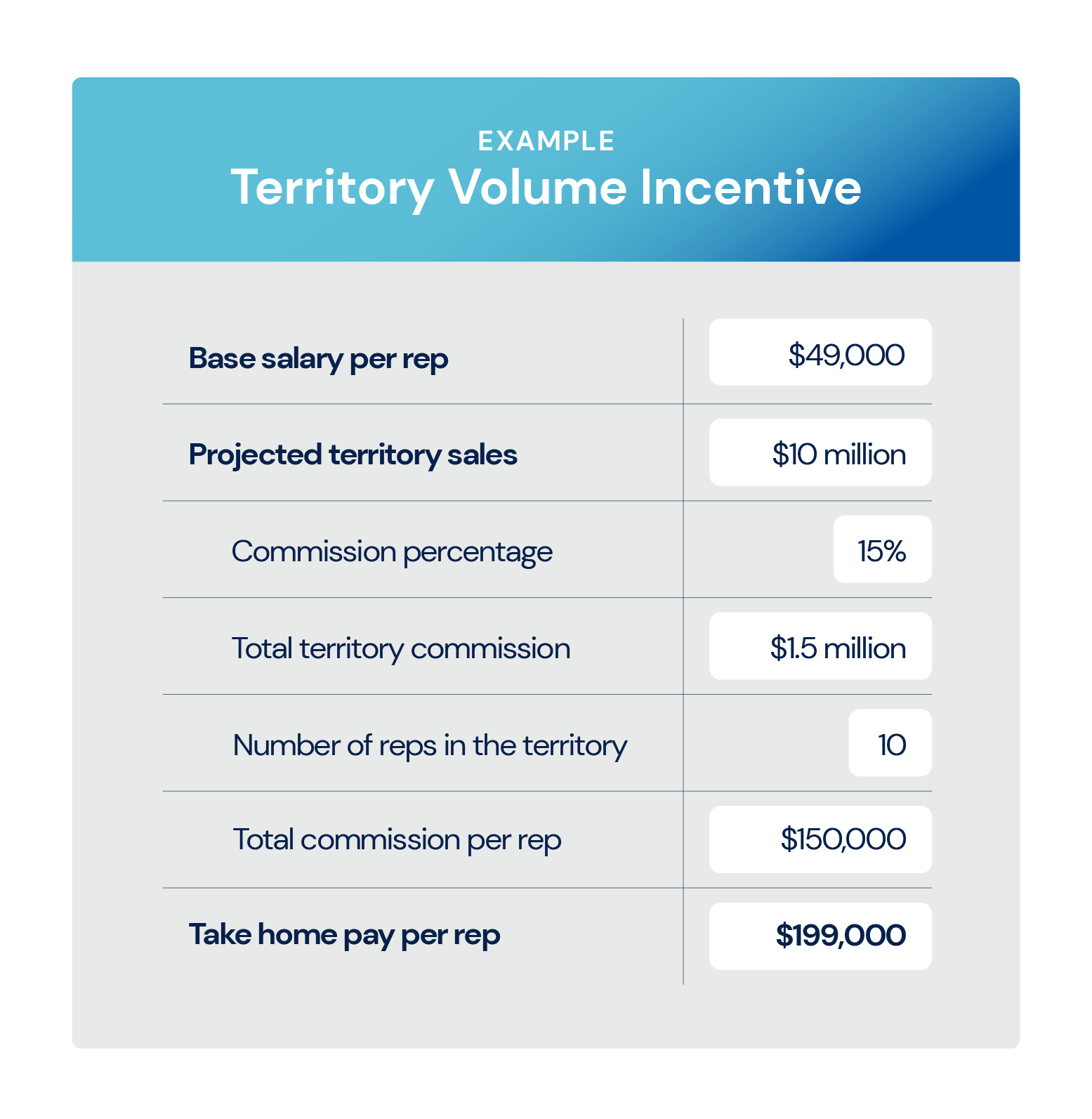

Territory Volume Incentive

A territory volume incentive is a type of sales compensation plan that rewards employees based on the amount of business they generate in a specific geographic area.

This type of plan is often used by businesses with multiple locations, as it allows them to compare the performance of sales reps in different areas.

Under a territory volume incentive plan, reps are typically given a quota for the amount of business they must generate in their assigned territory. They may also be given additional quotas for specific products or services. They will receive a bonus or commission if they meet or exceed their quotas.

Pros of a territory volume incentive plan include:

- Fosters a low-stress environment for salespeople

- Promotes team building

- Can help a business strengthen service in a target area

Cons of a territory volume incentive plan include:

- Can lead to dissent if salespeople feel like not everyone is pulling their weight

- Territories need to produce enough sales to pay compensation

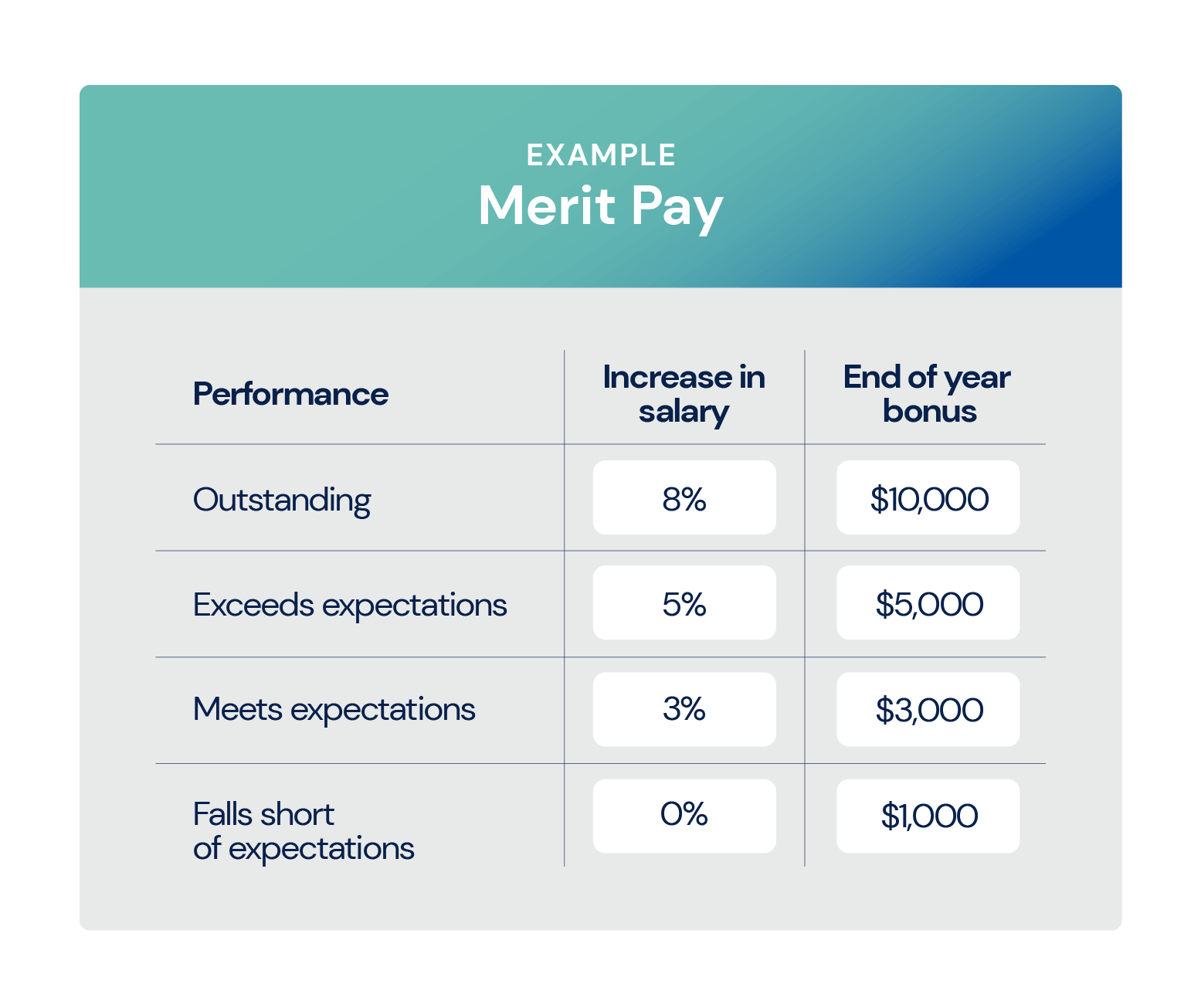

Merit Pay

A merit pay plan is a sales compensation plan that rewards employees based on their performance. This type of plan typically includes some evaluation process, such as a quarterly or annual review, in which employees are rated on their performance. The amount of the bonus or pay increase is then determined by their rating.

Merit pay plans can be used to reward top performers and encourage all employees to improve their performance. However, they can also create feelings of envy and resentment among employees if not implemented carefully.

Pros of a merit pay system include:

- Increases retention for top-performing employees

- Encourages all employees to improve their performance

Cons of a merit pay system include:

- May negatively impact morale if not implemented correctly

- Requires detailed and accurate data to measure performance effectively

6 Steps To Create a Sales Compensation Plan

Creating a sales compensation plan may seem daunting, but it doesn’t have to be. By following these six steps, you can create a plan that will work for your business and help you attract and retain top sales talent.

1. Select the Type of Compensation You Want

The first step in creating a sales compensation plan is deciding what type of compensation you want to offer.

This can be a complicated decision, so ask yourself these questions:

Do you value performance or retention?

If your hiring costs are low and you can afford some turnover, you may consider budget-friendly options like a straight commission plan or a set rate commission plan.

If you’d rather focus on keeping a low turnover rate, consider adding a competitive salary to your compensation plan.

What can you afford?

If you’re looking to attract top sales talent and you have a pretty relaxed budget, consider desirable options like equity bonuses or profit sharing.

How competitive do you want the sales office to be?

Some people believe that a competitive sales force is a productive sales force. If you follow this school of thought, you might pick a compensation plan that shows everyone exactly where they stand, like a merit pay system or a benchmark-based commission plan.

2. Determine Your Break-even Point

A break-even point is the number of units that must be sold in order to cover all costs associated with making and selling those units. In other words, it’s the minimum amount of sales necessary to keep your business afloat.

If you want to create a sales compensation plan that is truly effective, you need to make sure it aligns with your company’s break-even point.

Salaries are a fixed expense, but commission and bonuses can vary greatly depending on how well your reps do. To ensure that your compensation plan is sustainable, you need to make sure that the total amount you pay out in commissions and bonuses doesn’t exceed your break-even point.

If it does, you’ll be operating at a loss, which is not a sustainable business model.

3. Set Sales Goals

If you want your sales reps to reach their full potential, you need to set sales goals.

Sales goals give reps something to strive for and provide a sense of direction. Without sales goals, reps may not be sure what they should be focused on, and they may end up wasting time on activities that don’t contribute to the bottom line.

There are a few different types of sales goals that you can set for your reps:

- Grow revenue: This is perhaps the most important sales goal, as it directly contributes to the bottom line.

- Increase conversion rate: Another important sales goal is to increase the conversion rate or the percentage of leads that are converted into paying customers.

- Decrease customer churn: Customer churn, or the percentage of customers who cancel their subscriptions, is another important metric to track.

- Shorten time to close: The time to close is the amount of time it takes for a rep to convert a lead into a paying customer.

- Increase close rates: Close rates are the percentage of sales opportunities that reps convert into paying customers.

- Increase upselling and cross-selling: Upselling is when a rep sells a customer a more expensive version of a product they were already interested in. Cross-selling is when a rep sells a customer a complementary product to the one they were already interested in.

- Increase deal size: Deal size is the average amount of money a customer spends on your product.

4. Pick the Right Payroll Software

Get the most from your sales reps by using payroll software that can automate commission payments. This type of software can help you keep track of sales, calculate commissions, and pay out reps automatically.

Software should fulfill key needs, including:

- Automated taxes: the best payroll software will automatically withhold taxes from each paycheck.

- Time tracking: this is important for two reasons. First, you need to make sure reps are working their required hours. Second, you may want to offer commissions for after-hours work.

- Online access: make sure the software you choose can be accessed online so that reps can check their balance and see their sales numbers anytime, anywhere.

- Flexible payment methods: some payroll software allows for different types of payments, like direct deposit or paper checks.

- Compliance management: this is important to make sure you’re following all the rules and regulations regarding payroll.

- Expense integrations: if you want to reimburse reps for expenses, make sure the payroll software you choose can integrate with your expense management software.

- Direct deposit: this is the most common method of payment for employees.

- Robust reporting: payroll software usually comes with a slew of reports, like year-end forms and tax reports.

The most important thing to consider when choosing payroll software is whether it will meet your needs.

If you have a small business, you might not need all the bells and whistles that come with more powerful software. On the other hand, if you have a complex payroll system, you’ll want to make sure the software can handle it.

5. Set Sales Quotas

Sales quotas will help you establish expectations with salespeople. Quotas will also help establish on-target earnings, giving reps an idea of what they can expect to earn over time.

The best way to set sales quotas is to use data from past performances. This could be either your own company’s sales data or industry benchmarks.

Once you have this data, you can set quotas that are achievable but challenging. You should also review and adjust these quotas regularly.

Make sure you communicate the quotas to salespeople clearly. They should understand what is expected of them and how their performance will be measured.

Here are five types of sales quotas you may consider implementing:

- Forecast quota: a forecast quota is based on your company’s sales goals. This could be either for a specific period of time or for the entire year.

- Profit quota: a profit quota is based on the total profit generated from sales. This usually includes the revenue, minus the cost of goods sold, commissions, and other expenses.

- Volume quota: a volume quota is based on the total number of sales made. This could be in terms of dollars, units sold, or some other metric.

- Activity quota: an activity quota is based on the number of activities completed, such as number of sales calls made, emails sent, or appointments set.

- Combination quota: a combination quota is based on a combination of two or more of the above. For example, a sales quota could be based on both the number of sales made and the total profit generated.

6. Measure Performance

Once the plan is set, you’ll have to make sure it’s working. To do this, you’ll need to track performance against the quotas set.

There are a few key sales metrics you should track:

- Sales volume: this is the total number of sales made or total revenue generated.

- Average sale size: this is the average value of each sale.

- Win rate: this is the percentage of successful sales.

- Conversion rate: This number measures how many leads are converted into sales.

- Activity levels: this metric tracks the number of activities completed, such as sales calls made, emails sent, or appointments set.

- Turnover rate: this metric measures how long reps stay in their role. A high turnover rate can be a sign that something is wrong with your sales compensation plan.

- Customer satisfaction: this number measures how likely customers are to do business with you again or recommend you to others. The most successful salespeople will put customers first.

Each of these metrics can tell you a lot about your compensation strategy.

If you see a high turnover rate, for example, you may consider a more balanced compensation structure, like salary plus commission.

If your activity levels are low, you may think about sprinkling in a few extra incentives.

And if your customer satisfaction is low, your salespeople may be prioritizing their commission over your company’s interests.

No matter what your metrics say, always be willing to revisit and improve your sales compensation plans. The best way to find out what works is to experiment and iterate.

Sales Compensation Templates

We have put together templates for each of the compensation plans listed above.

Access the sales compensation templates

To edit the sheet, “Make a copy” of the document.

Supercharge Your Sales With a Compensation Plan That Excites

Sales compensation plans are a key part of any sales organization, yet they’re often overlooked or not given the proper attention.

By understanding the different types of sales compensation plans and how they work, you can develop a plan that’s aligned with your company’s goals and objectives.

And by regularly revisiting and refining your plan, you can ensure that it continues to drive results for your business.

Compensation can be a touchy subject, but at least your email outreach doesn’t have to be. Learn how you can cut costs and increase leads by automating your email outreach today – this way, your team can spend more time earning that commission!